Our commercial advice skills range from due diligence (technical, market and financial), to portfolio strategy and market analysis.

Osterwald Rathbone & Partners’ reputation in transaction support has arisen from our ability to apply a unique blend of industry and financial skills to mergers and acquisitions. As a result, our team assist clients with transaction valuations and negotiation, through to completion.

In particular, we provide objective advice and support to investors in the energy industry to assist their decision-making processes. On many occasions we have helped raise finance in support of investments or transactions. As an example, we often prepare “bank friendly” financial models, which helps to explain the credit story to banks or other providers of finance. Often this results in us also assisting with the negotiation of terms and conditions.

Case Study

North Sea upstream during the downturn

A few years ago, the North Sea oil and gas sector entered a sharp downturn. The sudden drop in the price of crude oil, combined with the maturity of the fields in the region, made for a very pessimistic outlook. Despite the conventional wisdom that it would be difficult for the UK North Sea to recover to similar levels as was the case during its peak before the oil price crash.

We advised an investor consortium in its potential acquisition of a network of North Sea oil and gas pipelines, producing platforms and onshore processing facilities. The assignment was complex, as the assets involved were being sold by tender.

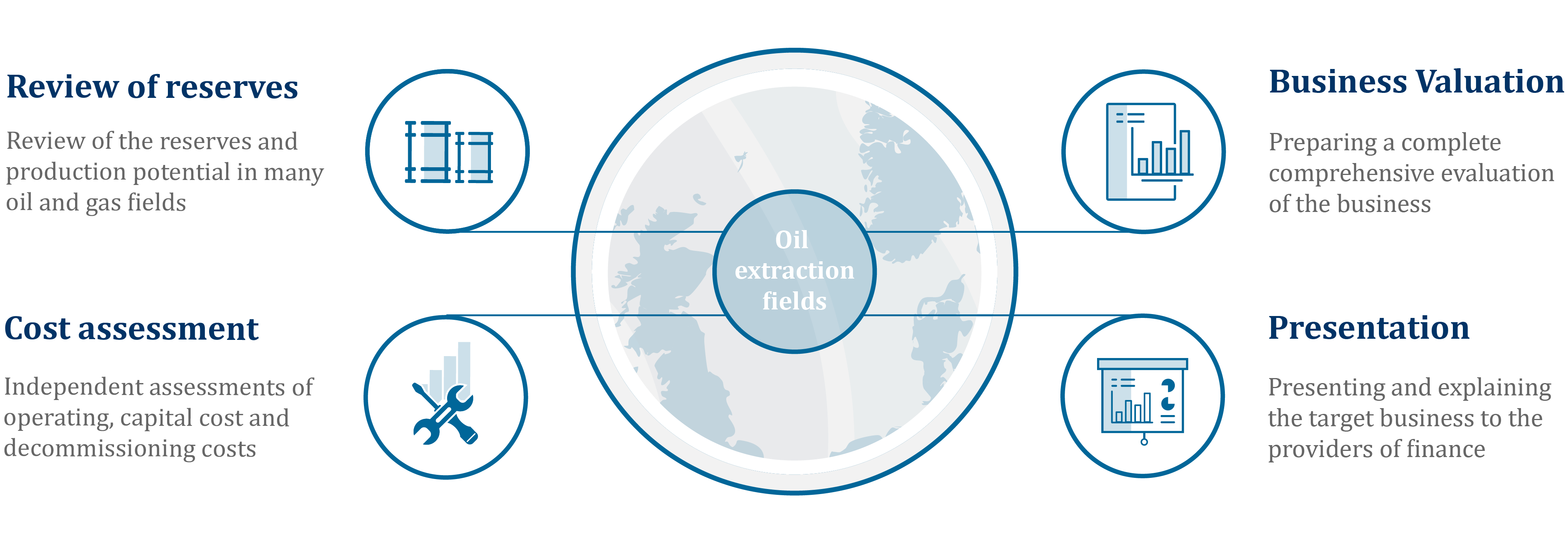

Our remit included:

Case Study

North Sea upstream during the downturn

A few years ago, the North Sea oil and gas sector entered a sharp downturn. The sudden drop in the price of crude oil, combined with the maturity of the fields in the region, made for a very pessimistic outlook. Despite the conventional wisdom that it would be difficult for the UK North Sea to recover to similar levels as was the case during its peak before the oil price crash.

We advised an investor consortium in its potential acquisition of a network of North Sea oil and gas pipelines, producing platforms and onshore processing facilities. The assignment was complex, as the assets involved were being sold by tender.

Our remit included:

Review of reserves

Review of the reserves and production potential in many oil and gas fields

Business valuation

Preparing a complete comprehensive evaluation of the business

Cost Assessment

Independent assessments of operating, capital cost and decommissioning costs

Presentation

Presenting and explaining the target business to the providers of finance